3. Who has the right to trade and/or export minerals?

The following mineral right holders have the right to trade or dispose mineral products recovered: special mining licence, mining licence, primary mining licence, processing licence, smelting licence, and refining licence.

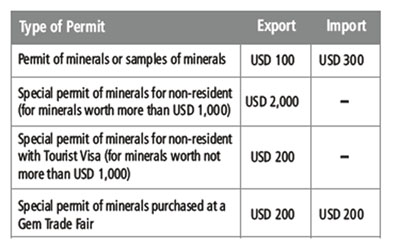

Additionally, holders of dealer licence and broker licence have the right to buy, acquire, sell or dispose minerals as per Sections 76 and 83 of the Mining Act, 2010 respectively. Regulation 16 of the Mining (Mineral Trading) Regulations, 2010 permits a non-resident to export minerals acquired by him/her from authorised miner or licensed dealer by applying to the Commissioner for Minerals, upon payment of fees as set out in the First Schedule, for export permit for such minerals. In this case, a special export permit is issued to the applicant by the Commissioner for Minerals.

Furthermore, Regulation 17 of the Mining (Mineral Trading) Regulations, 2010 permits a non-resident to export minerals obtained from a Gem Trade Fair in Tanzania after payment of fees for the export permit for such minerals.

The buyer is also supposed to provide proof of payment of royalty for the minerals to be exported. A non-resident with a Tourist Visa is permitted, under Regulation 16(2) of the Mining (Mineral Trading) Regulations, 2010 to export minerals (not more than twice a year) after paying the required export permit fee for minerals with value not exceeding USD 1,000. However, a much higher export permit fee is charged in case the value of minerals to be exported exceeds USD 1,000.

Note: Holders of broker licence are not authorized to export minerals.

4. What are the permits required for exporting minerals?

Minerals or samples of minerals can only be exported by a mineral right holder or a licensed dealer. A nonresident with an ordinary, business or tourist visa can also export minerals acquired legally in the country after obtaining a special export permit from the Commissioner for Minerals as stipulated in the Act.

The following permits are a prerequisite for exporting minerals or samples of minerals from Tanzania:

Eng. Dominic K. Rwekaza Chief Executive Officer Tanzania Minerals Audit Agency

Eng. Dominic K. Rwekaza Chief Executive Officer Tanzania Minerals Audit Agency

a. Export Permit: Export Permit for minerals or samples of minerals is issued by the licensing authority stating, among others, name of licence holder, licence number, type of minerals, net weight, value of minerals to be exported, certification for payment of royalty, date issued, validity of export permit and name of issuing officer.

b. Export Permit for Minerals from Gem Trade Fair: Regulation 17 of the Mining (Mineral Trading) Regulations, 2010 permits non-residents to export minerals obtained from a Gem Trade Fair in Tanzania after payment of fees and royalty. In that case, an Export Permit for Minerals from Gem Trade Fair is granted by the Commissioner for Minerals as per Form MTF 18.

c. Certificate of Origin for Tanzanite Minerals: Regulation 18(1) of the Mining (Mineral Trading) Regulations, 2010 requires every Export Permit for Tanzanite to be accompanied by a Certificate of Origin issued by an authorized officer. The certificate of origin states, among others, name of licence holder, net weight and value of Tanzanite to be exported, date issued and name of issuing officer.

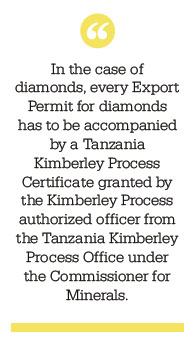

d. Tanzania Kimberley Process Certificate: In the case of diamonds, every Export Permit for diamonds has to be accompanied by a Tanzania Kimberley Process Certificate granted by the Kimberley Process authorized officer from the Tanzania Kimberley Process Office under the Commissioner for Minerals.

e. Special Export Permit: Regulation 16 of the Mining (Mineral Trading) Regulations, 2010 requires a non-resident who wishes to export minerals acquired by him/her from an authorised miner or licensed dealer to apply for a Special Export Permit from the Commissioner for Minerals.

However, in case of a non-resident with a Tourist Visa, a different fee applies for exporting minerals with value not exceeding USD 1,000. The same Regulation prohibits the tourist to be issued with a Special Export Permit for more than twice in a year. In any of the cases above, evidence for payment of royalty for minerals to be exported has to be provided by the exporter.

Note:

I. Every permit to export minerals or samples of minerals has to be accompanied by authentic Invoices and Government Exchequer Receipt Vouchers (ERVs) for export permit’s application fee and royalty payment.

ii. Regulation 5(4) of the Mining (Mineral Trading) Regulations 2010 requires every permit to export minerals or samples of minerals to be surrendered by the holder to a Government Official (Customs or Postmaster) at the point of exit from Tanzania. The original permit has to be forwarded to the authorized officer by whom it was issued.

5. What are the permits required for importing minerals?

Regulation 4 of the Mining (Mineral Trading) Regulations, 2010 requires importation of minerals or samples of minerals into Tanzania to be done after obtaining an Import Permit from the Commissioner for Minerals.

The permit shall indicate, among others, name of the importer, type, weight and value of minerals or samples of minerals to be imported, place of entry, destination, means of transportation, and purpose of importation, import fee, date of issue and issuing officer.

Regulation 6(9) of the Mining (Mineral Trading) Regulations, 2010 requires the import permit to be submitted to the collector of customs who shall forthwith forward the same to the Commissioner for Minerals.

Note:

I. Re-exportation of Minerals and Samples of Minerals: Regulation 7 of the Mining (Mineral Trading) Regulations, 2010 stipulates that imported minerals shall not be exported by the importer unless an export permit is obtained from the Commissioner for Minerals, and the Commissioner is satisfied that the minerals to be exported comprise the whole or part of the minerals to which the import permit relates.

ii. Minerals on Transit: Minerals on transit are handled under the Tanzania customs regulations, under which the minerals are inspected on arrival where packages/containers are verified.

In the case of radioactive minerals, radioactivity check on the minerals has to be conducted by Tanzania Atomic Energy Commission (TAEC) in collaboration with the Commissioner for Minerals as guided under Section 108 of the Mining Act, 2010 and the Mining (Radio active Minerals) Regulations, 2010.

Shipments and seals are re-inspected at exit points to ensure that no tampering has occurred en route.

It is important to emphasize hereby that Section 101(5) of the Mining Act, 2010 gives the Commissioner for Minerals or any other authorized officer, powers to enter and search (without a search warrant) any premises, vehicle, vessel or aircraft in case there is reasonable grounds to believe that an offense under the Act has been committed.

In this case, the Commissioner for Minerals and TMAA have the powers to search minerals on transit in case there is reason for doing so.

6. What are the penalties for offences relating to unauthorized trading/export of minerals?

Section 18(2) of the Mining Act, 2010 prohibits any person other than a mineral right holder, a licensed dealer, or licensed broker to have in his possession, or dispose of, any mineral or samples of minerals, unless as an employee, agent or contractor, he has acquired and holds the mineral or minerals for or on behalf of a mineral right holder, licensed dealer or a licensed broker.

Section 18(3) of the Mining Act, 2010 prohibits any person to export from Tanzania any mineral or samples of minerals unless he/she is a mineral right holder or a licensed dealer and has been granted an export permit after paying the royalty due.

According to Section 18(4) of the Mining Act, 2010 any person who contravenes the above provisions of the Act commits an offense and on conviction he/she is liable to a fine not exceeding ten million Shillings or to imprisonment for a period not exceeding three years or to both (for an individual); in case of a body corporate to a fine not exceeding fifty million Shillings.

Additionally, Section 6(4) of the Mining Act, 2010 authorizes the Commissioner for Minerals to forfeit minerals obtained in the course of unauthorized prospecting or mining operations including equipment involved in such operations.

7. What are the key powers of the Commissioner for Minerals and other authorized officers?

a. To enter and search any premises, vehicle, vessel or aircraft (without a search warrant) in case there is a reasonable ground to believe that an offense under the Act has been committed - Section 101(5) of the Mining Act, 2010.

b. To take soil samples or specimen of rocks, ores,concentrate, tailings or minerals for the purpose of examination or assays – Section 101(1)(e) of the Mining Act, 2010.

c. To obtain any information which may deem necessary for the administration of the Mining Act – Section 101(1)(g) of the Mining Act, 2010.

d. To arrest any offender, with the assistance of the Tanzania Police Force.

e. To forfeit minerals obtained in unauthorized manner – Section 6(4) of the Mining Act, 2010.

8. What role does TMAA play in combating of illegal trading and smuggling of minerals?

The Tanzania Minerals Audit Agency (TMAA) is a semi-autonomous institution established in 2009 under the Executive Agencies Act, Cap. 245.

The Agency was established under G.N. No. 362 of 6th November, 2009.

The Agency’s authority to monitor and audit mining operations in the country is also given under Section 4 of the Mining Act of 2010.

The aim of TMAA is to facilitate maximization of Government revenue from the mining industry through effective monitoring and auditing of mining operations and ensuring sound environmental management in the mining areas.

Under the above mentioned Establishment Order, Tanzania Minerals Audit Agency, among other functions, is mandated to counteract minerals smuggling and minerals royalty evasion in collaboration with relevant Government authorities, mainly the Minerals Department, Tanzania Revenue Authority, Tanzania Airports Authority, Tanzania Police Force and Immigration Department.

In order to implement effectively this task, TMAA has established Minerals Auditing Desks at the Julius Nyerere International Airport, Kilimanjaro International Airport and Mwanza Airport.

9. What are the fees charged for exportation and importation of minerals?

10. What are the royalty rates on minerals sales?

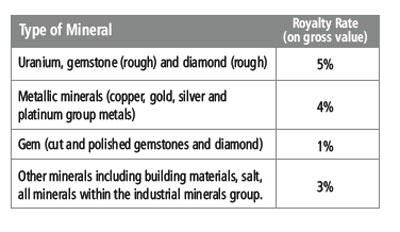

Section 87 of the Mining Act, 2010 stipulates various rates for royalty payments on minerals as highlighted below: s